TOM CROTTY

ERTC AGENT & BUSINESS CONSULTANT

15 Pleasant Street, Middletown, CT 06457 (860) 759-3029

trc3999@gmail.com

LET US HELP YOU GET YOUR FREE FEDERAL $$$ NOW!

Use the REFUND as you see fit!

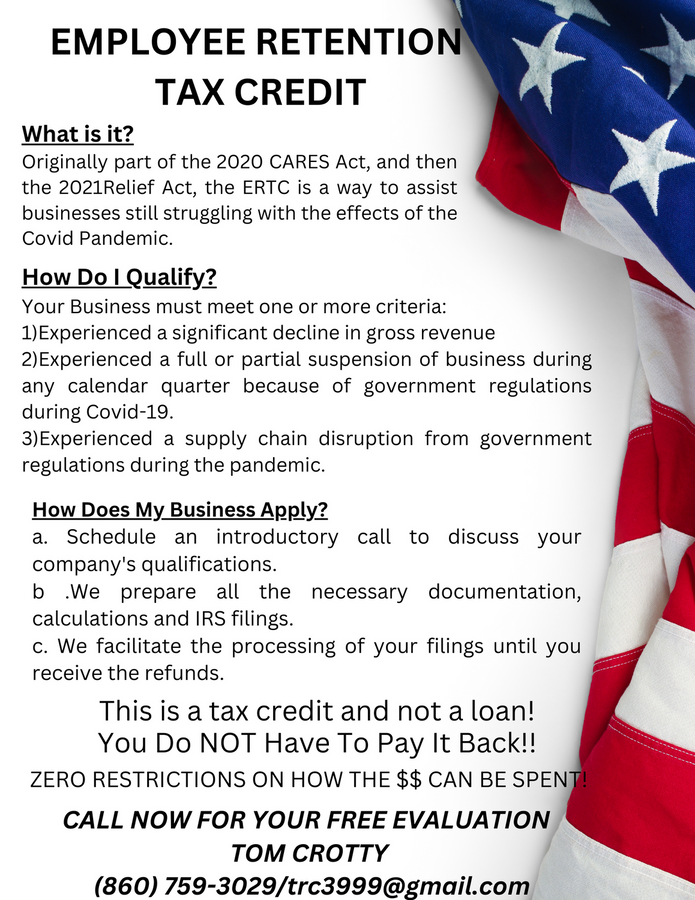

During the Pandemic, did you experience at least one of the following: 1)Loss of Revenue, 2)Shut-down, 3)Supply Chain Issues

Receive Minimum $5,000 to Maximum $26,000 per W2 Employee

Did you have at least 5 W2 employees in 2021-2022?

ERTC Consultant Fee is 15% (Gross Refund $$ -15% fee = NET REFUND AMOUNT)

Allow your ERTC Consultant to file for your CARES ACT REFUND

TOM CROTTY

ERTC AGENT & BUSINESS CONSULTANT

15 Pleasant Street, Middletown, CT 06457 (860) 759-3029

trc3999@gmail.com

In 2020…

Congress set aside $2 Trillion Dollars of The CARES ACT for the “Employee Retention Tax Credit” or “ERTC”.

As of April 2023…

Congress has paid out only $50 Billion Dollars in ERTC Refunds.

Don’t Miss Out!

A part of the remaining balance of $1.95 Trillion Dollars can be yours!!

THE TIME TO ACT IS NOW!!

WIN-WIN FOR ALL!!

✓ ✓

✓

# W2 Employees

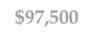

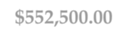

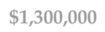

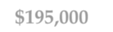

5

25

50

100

LET US HELP YOU GET YOUR FREE FEDERAL $$$ NOW!

ERTC:

Employee Retention Tax Credit

CHECK YOUR ELIGIBILITY

FILE YOUR DOCUMENTS

RECEIVE YOUR $$$

TOM CROTTY

ERTC AGENT & BUSINESS CONSULTANT

15 Pleasant Street, Middletown, CT 06457 (860) 759-3029

trc3999@gmail.com

One of the questions I often hear is… Can I do it myself?

The answer is… Yes, you can.

But why?

Before you go it alone, you must ask yourself first…

1. Do you have hours and hours of extra time available?

•

There are hundreds of pages of IRS documents to go through that are constantly

changing!

Having the help of an expert that does this all the time makes a lot of difference.

Without the help of an expert, you could make a costly mistake and miss out on getting

the maximum refund you qualify for!

If any issues arise with the IRS, we’ve got your back!

Our Tax Experts deal directly with the IRS for you!

As IRS specialists, we are equipped to answer questions and solve issues, if and when

they arise.

To give you an example… I have a great Primary Care Doctor, but there were many

times when he referred me to a Specialist, who focuses on one particular area of

medicine.

This is the era we live in. There are experts in every field!

A great deal of our business comes from CPAs that could very well do this program.

However, this is an Accounting & Payroll expertise & niche program. The time

involved is just not worth it for many of them and that’s why they refer their customers

to us!

The American CARES ACT was created to help fund businesses, like yours, that may

have been hurt by the Covid-19 Pandemic.

The Employee Retention Tax Credit (ERTC) Program is here now to help you!

It is a federal niche program, designed to help small businesses, nonprofits, churches,

and more…

Money has already been set aside by the Government to help you, but there is a finite

budget available in a limited window of time.

It’s free to qualify. You don’t pay any money upfront and like a legal case, it’s a

contingency - We don’t get paid unless you do and when you do!

This is probably the last window for free federal funds to use as you see fit!

2. Would it help to have a Tax Expert on your side?

• •

3. Do you believe in doing things right the first time? We do!

• • •

•

• •

4. Would you and your business benefit from an influx of funds with no cost to you?

•

•

•

• • •

LET US HELP YOU GET YOUR FREE FEDERAL $$$ NOW!

TOM CROTTY

ERTC AGENT & BUSINESS CONSULTANT

15 Pleasant Street, Middletown, CT 06457 (860) 759-3029

trc3999@gmail.com

For all those in business, in so many different venues, there has never been a time in history like what we are going through now (since the Covid-19 Pandemic) that has affected so many people, in so many ways. Why are there so many challenges and concerns? What is going on within our own country and business? The purpose of this letter is to address help for businesses that have lost in several different ways to COVID-19, and its aftermath.

The Pandemic has become the Capitalism Apocalypse! Retail is in a downspin and for many it is a lifetime

of commitment and hard work by generations of Americans. If we don’t start fighting back and pulling

together this will be an economic depression for many - worse than the 30s and some will never see the

light of day. I don’t want that to be you. I don’t want that to be me. I don’t want that to be anybody that

loves this country.

I could go on and on with individual areas, issues, mistakes, missteps, shutdowns, etc. and right now we

are focused on trying to get some help for those that still believe in this country and still believe in

themselves.

Whether you took out loans - PPP or others, or if you had to declare bankruptcy or experience closures, we

are here to try to help you financially. The CARES ACT (Covid Aid, Relief & Economic Security Act) was

passed just for this reason. By now you have probably heard of the CARES Act and what it could do for

small businesses if you had a minimum of at least five W2 employees on payroll in 2020- 2021.

The problem is, it's complicated. And they continue to modify everything as we go along. Recently, the IRS

has added over 200 pages to what was already there. The changes are constant and it’s why you need an

expert tax consultant company to try to get the money that you deserve and that has already been put aside

for you! Congress has allotted $2 Trillion Dollars and so far, only $50 Billion has been claimed!

You have already lost so much, why not try and gain some of it back? This isn’t going to solve all the

problems, but it’s a start. And again, you have nothing to lose with this program. There is no cost to try to

qualify. No upfront costs. Just like a lawyer that takes a case on a contingency - We don’t get paid unless

you do.

This money is not a loan, it’s not a grant. You can do whatever you feel is needed. It’s going to be your

decision; spent the way you feel is best. Start turning this around today! Please check out the rest of the

information and get in touch with us so we can find out what we can do for you.

Please let us try to save some businesses. Try to save some jobs. Try to save some families.

Thank you very much for your time. I look forward to speaking with you soon.

Tom

LET US HELP YOU GET YOUR FREE FEDERAL $$$ NOW!

TOM CROTTY

ERTC AGENT & BUSINESS CONSULTANT

15 Pleasant Street, Middletown, CT 06457 (860) 759-3029

trc3999@gmail.com

Let’s face it. When it comes to non-profits, churches and similar organizations, the amount of help they give far outweighs the amount of help they get! These organizations played a large part in helping communities all over the country by providing necessary services during the Covid-19 Pandemic.

And now, as things are slowly returning to normal for many of us, churches and other non-profits are

still experiencing negative effects financially. According to one financial services website, “feeling an

increased demand for many of the services provided without an equal increase in funds and staffing,

made surviving the pandemic a challenge for many non-profits and churches”. And “this prolonged

imbalance has negatively affected the financial health of many organizations”.

To survive, these charitable groups rely on fundraising, donations, and grants as their primary source

of income; all of which can be a massive undertaking. Raising money can be burdensome and is a

never-ending effort for these organizations that many Americans have come to rely on. They

deserve as much help and support as they give to others!

Congress passed the CARES Act for this very reason! Financial relief is finally here with the Employee Retention Tax Credit (ERTC). However, because most of the information provided was centered around small businesses, many don’t realize that

financial compensation is also available

to non-profit organizations as well.

We are here to help these organizations secure their refund andclaim the

free government money that has already been set aside for them.

That’s where we come in.

Through the CARES Act,

Congress has allotted $2 Trillion dollars for the ERTC. And to date, only $50 Billion dollars has been claimed! Why not apply and get the financial help you deserve? As those in the business of caring say…

“You Can’t Help Others Until You Help Yourself ”

1 | Page